Does the Fed really matter?

The Federal Reserve has been in the headlines a lot lately as analysts try to figure out when policymakers will cut interest rates.

Why does the Fed matter so much?

Let’s discuss.

The Fed’s decisions on interest rates are a big deal for markets and the economy because they affect how much it costs to borrow money.

Since businesses and consumers depend on credit to buy houses, fund business growth, pay workers, and more, interest rate policy decisions ripple across the economy.

Higher interest rates make it more expensive to borrow money and can act as a brake on economic growth.

On the flip side, higher interest rates can be a boon for investors by increasing the yield on savings accounts, bonds, and other debt instruments.

If you’ve found yourself putting off a new mortgage until rates come down or hunting down the best yield on a savings account, you’re experiencing the Fed’s actions in play.

How does the Fed change interest rates?

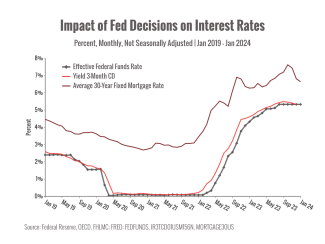

At a high level, the Fed sets the “target” for the Federal Funds Rate, which is the rate banks and large institutions charge each other.1

Right now, that target is set at 5.25%—5.5%, and the actual "effective" rate is about 5.3%.

Unfortunately, you and I don’t have access to rates that low.

The rates we can get as consumers, investors, and businesses are set above that lowest rate.

The rates offered on the market to borrowers and investors are based on factors like risk profile, collateral, and loan length.

You can see in the chart that 30-year mortgage rates are much higher than the base rate, in part because of the length of the loan.

How does the Fed influence the stock market?

You might have noticed how much stock prices can swing when fresh headlines about the Fed's decisions emerge.

That’s because, all things being equal, lower interest rates are considered better for company performance because they incentivize borrowing and help fuel growth.

When interest rates rise, companies must pay higher rates to access credit, which can hurt their future prospects (and stock price).

Since the stock market tends to be forward-looking, the prospect of lower rates can flip the “greed” switch and trigger a rally as investors bet on future company performance.

That’s what we’ve been seeing in the past few weeks.

When will the Fed lower rates in 2024?

That is the $64,000 question. We don’t know exactly.

The Fed is choosing to move carefully and assess the data.

While we’ve made serious progress in taming inflation, there’s still a ways to go before reaching the Fed’s target of 2% inflation.2

While many investors and economists hope the Fed will start cutting rates this spring and keep to their plan for multiple rate cuts this year, others aren’t convinced.3

Some analysts don’t think the Fed will be in a position to cut rates until next year.4

What does all this mean for investors?

Markets are likely to stay volatile as long as interest rates remain uncertain, especially approaching Fed announcement dates.

On the other hand, signs of lower inflation or other data that would support a cut are likely to be greeted with further rallying.

Bottom line: We’re watching, discussing, and strategizing how to position clients this spring.

Questions? Concerns? Give us a call and we'll be happy to help.

Sources

1. https://www.newyorkfed.org/markets/reference-rates/effr

3. https://www.cnbc.com/select/when-will-interest-rates-drop/

4. https://www.businessinsider.com/fed-first-rate-cut-forecast-us-economy-high-interest-impact-2024-2

Chart sources:

https://fred.stlouisfed.org/series/FEDFUNDS

https://fred.stlouisfed.org/series/MORTGAGE30US

https://fred.stlouisfed.org/series/IR3TCD01USM156N

https://fred.stlouisfed.org/series/CPIAUCNS

https://fred.stlouisfed.org/series/CPILFENS

Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.

For additional information and important disclosures, please click here.